When you consider out a loan, you must spend back again the loan moreover interest by generating common payments into the lender. So you can consider a loan as an annuity you pay back to a lending establishment.

The quantity you fork out in fascination will still go down when you pay back your loan due to the fact your principal stability will shrink, but you’ll normally use the exact same quantity to compute your every month fascination payment.

Kim Lowe is a direct assigning editor on NerdWallet's loans group. She handles customer borrowing, such as topics like personalized loans, scholar loans, buy now, fork out later and money advance applications. She joined NerdWallet in 2016 immediately after 15 years at MSN.com, the place she held a variety of written content roles which includes editor-in-Main of your wellbeing and food stuff sections.

If you’ve been pondering borrowing dollars and therefore are curious to find out what payments would seem like before you decide to apply, a loan calculator can be an excellent Device to assist you to determine this out.

Property finance loan calculatorDown payment calculatorHow Significantly home am i able to find the money for calculatorClosing expenditures calculatorCost of living calculatorMortgage amortization calculatorRefinance calculator

When you've got some mix of fantastic to exceptional credit, a low debt-to-income ratio, continual money and assets, you could almost certainly qualify for some sorts of loans. Use loan calculators to reply your queries and assist you to Evaluate lenders so you get the most effective loan to your monetary situation.

Present-day mortgage rates30 yr mortgage rates5-calendar year ARM rates3-yr ARM ratesFHA mortgage loan ratesVA home loan ratesBest mortgage loan lenders

Then, the remaining loan stability will probably be multiplied by this month to month or periodic desire amount to work out what percentage of the month-to-month payment goes to desire.

Even though it can technically be regarded amortizing, this is frequently known as the depreciation cost of the asset amortized over its envisioned lifetime. For more information about or to do calculations involving depreciation, please visit the Depreciation Calculator.

Secured loans are backed—or secured—by collateral that your lender can repossess in case you 79 loan default. Collateral could be the money in the savings account or, in the situation of an vehicle loan or home finance loan, the vehicle or house you’re financing, respectively.

Vehicle insurance policies guideAuto coverage ratesBest car insurance plan companiesCheapest car insurancePolicies and coverageAuto insurance evaluations

To apply for a loan, borrowers have to complete an internet based application form and submit the necessary files, together with proof of profits and identification.

If you default on an unsecured loan, the only real way your lender can get their a reimbursement is by suing you in court. That’s a complicated course of action and it’s not certain to get the job done, so to compensate for that threat, lenders will usually demand larger charges on unsecured loans.

NerdWallet has an engagement with Atomic Spend, LLC (“Atomic Spend”), an SEC-registered investment adviser, to deliver you the chance to open up an expense advisory account (“Atomic Treasury account”). Investment decision advisory companies are furnished by Atomic Spend. Companies which can be engaged by Atomic Make investments receive payment of 0% to 0.85% annualized, payable every month, centered on property underneath management for each referred shopper who establishes an account with Atomic Commit (i.e., precise payment will vary). Atomic Make investments also shares a percentage of compensation obtained from margin curiosity and cost-free dollars interest attained by prospects with NerdWallet. NerdWallet isn't a customer of Atomic Devote, but our engagement with Atomic invest provides us an incentive to refer you to Atomic Invest in lieu of A further investment adviser.

Ralph Macchio Then & Now!

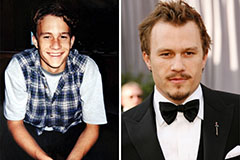

Ralph Macchio Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now!